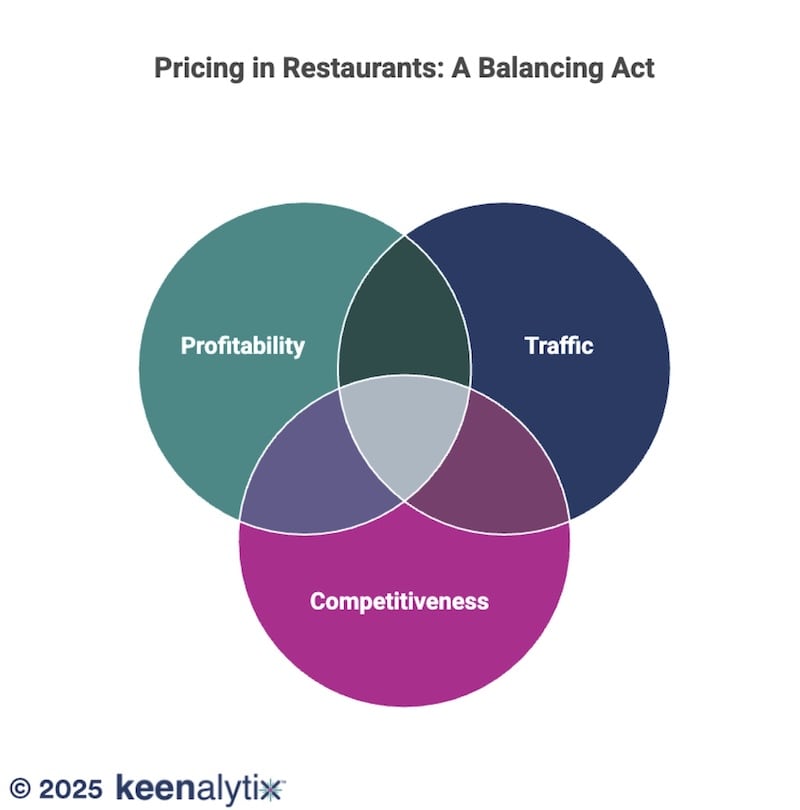

In the dynamic Quick-Service Restaurant (QSR) segment, optimal pricing is a complex endeavor, demanding a delicate balance of profitability, traffic, and competitiveness. The traditional approaches that once served the industry well are increasingly inadequate in today’s rapidly evolving market. Restaurant executives and investors must understand that yesterday’s pricing strategies, often based on reactive discounting or intuition, are no longer sufficient to navigate the intricate interplay of financial health, customer demand, and market rivalry.

The Three Pillars of QSR Success: A Closer Look

A restaurant’s financial health and market position are fundamentally shaped by three interconnected pillars: profitability, traffic, and competitiveness. Each plays a crucial, interdependent role in dictating the effectiveness of any pricing strategy.

Profitability: The Bottom Line Imperative

Profitability stands as the ultimate measure of a restaurant’s financial viability, reflecting its capacity to generate revenue beyond its operational costs. Key metrics for assessing profitability include Net Profit Margin, Food Cost Percentage (COGS), and Labor Cost Percentage.

For Quick-Service Restaurants (QSRs), the average net profit margin typically ranges between 6% and 9%, notably higher than the 2% to 6% average for full-service restaurants (FSRs). Top-performing QSR chains can achieve even more impressive margins; for instance, Chick-fil-A operators commonly experience profit margins between 20% and 30%, and Taco Bell reported over 24% restaurant-level margins in its company-owned stores in 2024. This “efficiency premium” stems from QSRs’ inherent design for low operating costs and high sales volume, requiring less staff and frequently utilizing more cost-effective, pre-prepared ingredients.

However, despite these generally higher margins, QSRs are not immune to financial pressures. Rising costs, particularly for food and inventory, have posed significant challenges, with restaurant operators experiencing a substantial 34% increase in food expenses in 2024. Labor costs also continue to climb, with 99% of operators reporting increased spending on labor in 2024. These factors underscore that even with an operational advantage, vigilant cost management and continuous operational optimization are critical for sustained profitability.

Traffic: The Volume Engine

Traffic refers to the volume of customers visiting and transacting with a restaurant, serving as a direct indicator of demand and market engagement. Key metrics include Same-Store Sales Growth (SSSG), Customer Visit Trends (transaction growth), and Digital Sales Penetration.

The U.S. restaurant industry experienced a slowdown in sales and traffic in 2024, with these negative trends persisting into the first quarter of 2025. Specifically, quick-service restaurants saw a 1.6% decline in visits in Q1 2025 compared to Q1 2024. This deceleration is largely attributed to higher prices, shifting consumer spending patterns, and intensified competition. Elevated inflation and rising cost-of-living pressures have notably reduced dining-out frequency, particularly among low- and middle-income consumers.

In response to these challenges, many QSR chains have engaged in aggressive “value wars” and promotional activities. While some promotions, like Denny’s BOGO for $1, can be profit-neutral but effectively boost transactions, others, such as McDonald’s $5 Meal Deal, have not always generated measurable incremental traffic initially. This creates a “value-traffic paradox” for operators: deep discounting may attract price-sensitive consumers but risks eroding already thin profit margins.

Crucially, digital channels and loyalty programs have emerged as vital drivers of traffic. Digital ordering and delivery have experienced exponential growth, outpacing dine-in traffic by 300% since 2014. Restaurants leveraging online ordering systems can increase takeout profits by 30%, partly because customers tend to spend 20% more when ordering through technology. Loyalty programs are also highly effective, with loyalty traffic doubling from 2019 to 2024, now accounting for 39% of total restaurant visits.

Competitiveness: The Market Edge

Competitiveness reflects a restaurant’s ability to attract and retain customers effectively against its rivals. Key metrics include Unit Growth Rate, the strength of the Value Proposition, and the Innovation Index. The U.S. QSR market is characterized by intense competition, with established chains constantly vying for market share against emerging fast-casual concepts and independent eateries. The global QSR market’s projected growth from $1,055.48 billion in 2025 to $1,930.14 billion by 2032 also signals heightened competitive pressures.

Competitive advantage in the QSR space is driven by several factors: continuous innovation in menu offerings and technological advancements, a compelling value proposition that resonates with evolving consumer preferences (convenience, quality, unique experiences), and rapid unit growth indicating strong market demand.

While price wars are a common competitive tactic, long-term viability extends beyond mere affordability. Consumers are increasingly prioritizing food quality and the overall dining experience over just the lowest price, demanding that QSRs effectively solve an “experience-value equation”. This means delivering perceived high value through a combination of quality, convenience, and a positive brand experience, rather than solely relying on low prices. True competitiveness is not solely about reacting to rivals’ pricing, but proactively shaping consumer expectations and consistently delivering on a multi-faceted value proposition that justifies their pricing strategy and builds lasting customer loyalty.

The Imperative for a New Framework

The challenges presented by rising costs, fluctuating traffic, and intense competition highlight that traditional, reactive pricing simply doesn’t work anymore. The “value-traffic paradox” and the need to solve the “experience-value equation” demand a more sophisticated, analytical approach. Relying on gut feelings or sporadic promotional cycles can lead to eroding profits or an inability to capture market share effectively.

To navigate this complexity, QSR operators need a robust lens through which to analyze their current market position, identify areas for strategic adjustment, and foster sustainable growth. This foundational understanding is provided by a strategic framework, conceptualized as “Pricing in Restaurants: A Balancing Act,” which identifies seven distinct pricing personas derived from the interplay of profitability, traffic, and competitiveness.

Understanding your current position is the first step towards market leadership. In our next article, we’ll unveil the 7 distinct QSR pricing personas – a critical tool for self-assessment and strategic clarity. Download our full “The QSR Pricing Playbook: 7 Personas for Smarter Strategy” for an in-depth analysis of your brand’s unique pricing identity and a comprehensive guide to mastering your pricing strategy.